What is a bank guarantee ? A bank guarantee is a financial instrument that covers the different parties in a transaction. Generally used in international trade transaction, they acts as an additional security in case of breach of contract like the un-ability to pay the supplier after the delivery of goods from the buyer or the un-ability to deliver the goods from the supplier.

Bank guarantee reduces the risk in transaction for companies that do not have an existing business relationship and have little means to ensure their counterpart will fulfil their obligations.

For instance, a buyer who contracted a bank guarantee in a trade that consists of company X sending a certain amount of products to a defined location will obtain the agreed upon guarantee if company X fails to deliver if the reasons falls into those stipulated in the contract. A bank guarantee , therefore, ensure that the contractor is covered in case of externalities. It acts as a form of insurance.

From the lender point of view, the bank guarantee make sure that the debtor's liabilities will be met. In contrary to the contractor, from the lender point of view, a bank guarantee is an additional risk because it represents a potential additional payoff which needs financing.

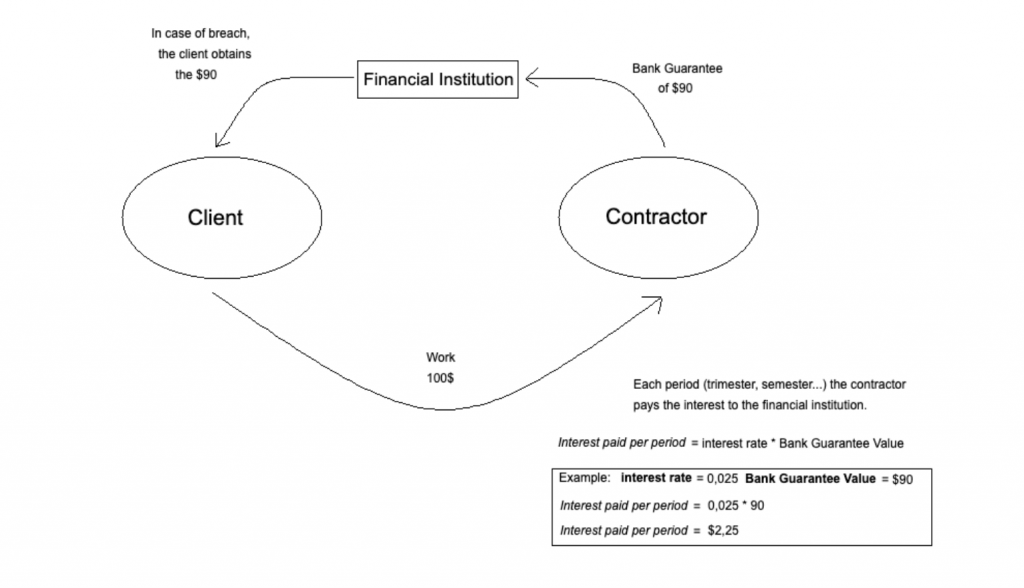

Consequently, a bank guarantee clause on a contract will translate into greater costs or interest rates. How is a bank guarantee made practically speaking? Let's take this example. A client need a work to be done in a 2 years time. They hire a contractor to do this job for a defined amount of money. To limit the risks of the contractor not fulfilling its duty in the time period, the client asks him to contract a bank guarantee. The contractor then go to a bank (or any type of financial institution that offers this type of contract) and ask for a bank guarantee covering the totality or part of the amount of money he will get pay for the job. He will then hands this bank guarantee paper to the client.

The client has now insurance that if the contractor does not fulfil its contract they will get the defined amount of money the contractor covered when making the bank guarantee. To make this bank guarantee, the financial institution will ask for a collateral that is at least equal or superior to the amount of money the contractor asks the bank guarantee to cover and the bank will make this bank guarantee paper against this collateral.

The financial institution will also receive periodic interests equal to a percentage of the value of the bank guarantee from the contractor. In case of breach of contract, the client will claim the money. The financial institution can then liquidate the assets in collateral and pay the client.

Bank Guarantee Fraud: The only real Bank Guarantee Many financial institutions may offers products label as bank guarantee but only one has the legal right to issue a document called Bank Guarantee, and that financial entity is none other than The World Bank. The World Bank offers bank guarantees for international trade & projects to companies and governments after a thorough review process that may last several months to finance projects that no single banks could offers financing options for. Once the application has been validated and the project has been deemed loan-worthy, The World Bank contracts with others banks loans for the companies and guarantees to each of these banks that these companies will pay back the loan and that in event of default it will cover their debt. This is the only official financial product known as Bank Guarantee. Therefore, if one's come across such a product in other context it should be warry that it is most likely a fraud.

Where does the confusion comes from? Some others banks like Deutsche Bank, Chase Manhattan or Credit Suisse guarantee their loans in a similar fashion but it is not officially coined as a Bank Guarantee. Sometimes the term "bank guarantee" is also used to speak about others financial instruments in trade finance like letters of credit, demand guarantees and performance bonds. Less often it can be used to describe an aval, which is a promissory note that has been date-stamped and signed by a bank for its creditworthy customer like a certified check.

The Bank Guarantee Scam: Put simply, the scam involves fraudster promising high return on investment (ROI) if you put your money into their hands and invest into so-called Prime Bank Guarantee. One should be cautious about investment opportunities that are too good to be true. But what is a "too good to be true" investment? It is simply one that offers a yield that beats the market. 20-50% ROI on any financial instruments is extremely rare and comes with high risks. If an entity proposes you such rates without telling you about these risks or by telling you that it is a 100% sure rates it is most likely an attempt to scam you out of your money.

Trading financial instruments is a highly specialised field that is done by experts that have intimate theoretical and practical knowledge about international politics, law and economy.

For more details, visit https://www.actionfraud.police.uk/a-z-of-fraud/prime-bank-guarantee-fraud